Cyber Insurance Solutions

Meet cyber insurance and compliance requirements, save time on security tasks, focus on real threats, and protect against a breach faster than ever with Blumira.

Solve Emerging Cyber Insurance Challenges

Adding or renewing cyber insurance is becoming increasingly challenging with more stringent security requirements.

SIEM For Cyber Insurance

Check the box on your cyber insurance questionnaire for SIEM when you use Blumira’s easy-to-deploy platform. Our SecOps team does the heavy lifting for you, eliminating many of the challenges associated with traditional SIEMs and making cybersecurity accessible for teams of any size.

-

Data Retention For Cyber Insurance

One Year of Log Data

Cyber insurers (and many compliance regulations like PCI DSS) often require at least a year of log data history available immediately for forensics after a security incident. Blumira provides a year’s retention of your system logs, encrypted and secured to ensure the integrity of your data, which is helpful for investigation and recovery in the event of a ransomware attack. Contact us if you have additional storage requirements.

-

Threat Detection For Cyber Insurance

Identify Anomalous Attacker Behaviors

Blumira notifies you of threats other security tools may miss, sending you real-time alerts in under a minute of initial detection to help you respond faster than ever. Reducing your time to respond is key to stopping the impact and costly damage of a ransomware attack.

Get broad coverage with our integrations for on-prem and cloud services, collecting your logs for deep visibility while identifying potential threats. Once a threat is detected, you can act quickly with playbooks that provide instructions on how to respond. -

Ransomware Coverage

Meet Ransomware Insurance Requirements

Many cyber insurers require supplements along with typical questionnaires for ransomware coverage. These applications often ask for additional protections, such as the use of endpoint detection and response (EDR), security information and event management (SIEM), offsite and encrypted backups, business continuity, or incident response plans for ransomware scenarios.

With Blumira SIEM + XDR, you can easily satisfy many ransomware coverage requirements for logging, data retention, and a SIEM, while also identifying suspicious behavior before it results in a widespread ransomware attack.

One Year of Log Data

Cyber insurers (and many compliance regulations like PCI DSS) often require at least a year of log data history available immediately for forensics after a security incident. Blumira provides a year’s retention of your system logs, encrypted and secured to ensure the integrity of your data, which is helpful for investigation and recovery in the event of a ransomware attack. Contact us if you have additional storage requirements.

Identify Anomalous Attacker Behaviors

Blumira notifies you of threats other security tools may miss, sending you real-time alerts in under a minute of initial detection to help you respond faster than ever. Reducing your time to respond is key to stopping the impact and costly damage of a ransomware attack.

Get broad coverage with our integrations for on-prem and cloud services, collecting your logs for deep visibility while identifying potential threats. Once a threat is detected, you can act quickly with playbooks that provide instructions on how to respond.

Meet Ransomware Insurance Requirements

Many cyber insurers require supplements along with typical questionnaires for ransomware coverage. These applications often ask for additional protections, such as the use of endpoint detection and response (EDR), security information and event management (SIEM), offsite and encrypted backups, business continuity, or incident response plans for ransomware scenarios.

With Blumira SIEM + XDR, you can easily satisfy many ransomware coverage requirements for logging, data retention, and a SIEM, while also identifying suspicious behavior before it results in a widespread ransomware attack.

Blumira Users in Their Own Words

Hear what our customers are saying about Blumira.

“Blumira is a great solution — we didn’t have to spend six months on the tool to get it set up correctly. We were able to deploy quickly, not get flooded with alerts, and the team is really responsive when we need more help.”

Matt Varblow

VP of Engineering Services, AdvantageCS

“We’re required by CJIS and IRS Pub 1075 compliance to review our logs daily. Blumira has saved us time because we can’t monitor all of our logs — we would need a team of 100 to go through all of these logs manually.”

Mike Morrow

Technical Infrastructure Manager, Ottawa County

“With our old provider, it was a big time sink trying to filter through false-positives and close out events. As far as accuracy of detections, now we're able to respond to important activities sooner, since we're not wading through unimportant things.”

Bryan Allen

Sr. Systems Analyst, Lawrence Technological University

Additional Cybersecurity Insurance Resources

Get more resources

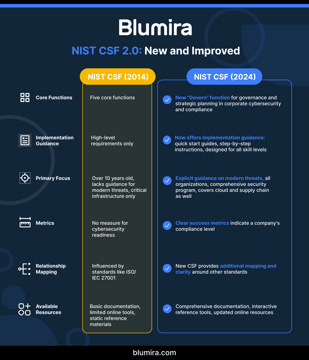

NIST Cybersecurity Framework Implementation for Mid-Market Companies: 2025 Update

Read MoreVideo - Security Monitoring Essentials for 2025 Compliance

Read MoreMeeting Florida's 2025 Cybersecurity Deadline: Funding and Compliance

Read MoreGet Started for Free

Experience the Blumira Free SIEM, with automated detection and response and compliance reports for 3 cloud connectors, forever.